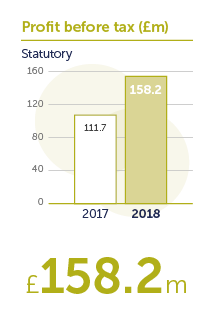

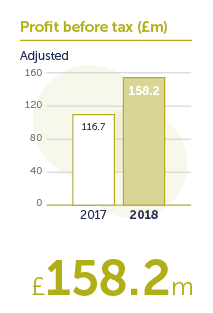

Despite heightened political and macroeconomic uncertainty due to the negotiations over the impending withdrawal of the United Kingdom from the European Union, Charter Court’s robust performance in 2018 demonstrates that the business remains resilient and able to deliver value for all our stakeholders.

Sir Malcolm Williamson,

Chairman

Despite heightened political and macroeconomic uncertainty due to the negotiations over the impending withdrawal of the United Kingdom from the European Union, Charter Court’s robust performance in 2018 demonstrates that the business remains resilient and able to deliver value for all our stakeholders.

Sir Malcolm Williamson,

Chairman

Charter Court Financial Service Group plc is the UK’s leading specialist mortgage lender, purpose built to meet increasing customer demand for specialist mortgages, attractive savings products, exceptional value and great service.

Strategic targets

Charter Court aims to deliver high quality growth and sustainable and attractive risk-adjusted returns. The Group attempts to accomplish its aims by maintaining balance and delivering success across its key goals:

A strong performance across both our lending and funding operations is helping us to continue to meet or exceed all of the targets set out at the time of our IPO.

Ian Lonergan,

Chief Executive Officer

| Strategic targets | KPIs | Medium term target | Delivery in 2018 |

|---|---|---|---|

OriginationDeliver sustainable balance sheet growth |

Originations | Stable |

£2.8 billion |

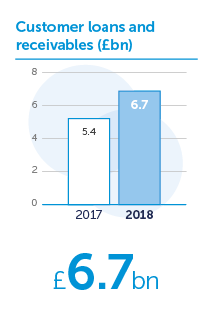

| Loan book growth | >20% |

24.2% |

|

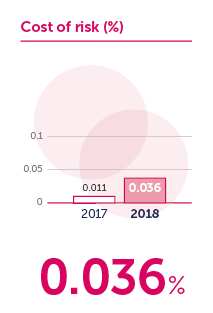

Risk managementMaintain disciplined risk management |

Cost of risk | Sector leading through the cycle |

0.036% |

| CET1 | Minimum 13% |

15.7% |

|

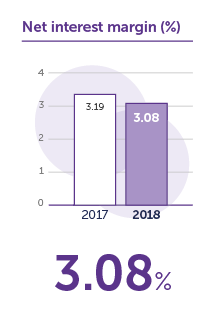

ProfitabilityMaintain high levels of operating efficiency |

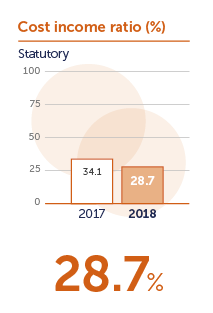

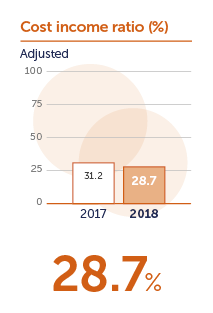

Cost income ratio | Low 30s (%) |

28.7% |

| Net interest margin | Above 3% |

3.08% |

|

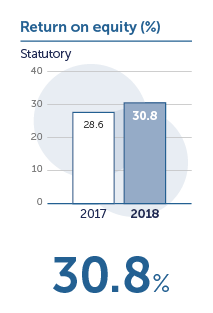

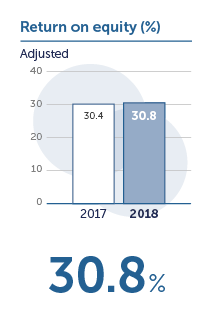

ShareholdersDeliver shareholder value |

Return on equity | Mid 20s (%) |

30.8% |

| Dividend pay-out | Minimum 25% pay-out ratio and progressive |

25% |

In addition to the financial targets above, the Group aims to develop two key non-financial goals:

Customer loyalty - We aim to deliver a quality service and product proposition to mortgage brokers and their customers and to retail depositors.

Leading employer - The Group also aims to maintain its status as a leading employer, with low staff turnover and high staff engagement. The Group measures this by monitoring attrition rates, absence rates and training hours achieved and by asking employees to complete The Sunday Times Top 100 Companies to Work For survey each year. In 2018 we were ranked as the sixth best place to work in the ‘mid’ sized business category (2017: third) and were the highest placed bank for a second year.

How we deliver our strategy

We operate in selected specialist mortgage markets where we can deploy our deep credit knowledge

We deliver a quality service and product proposition tailored to mortgage brokers and their customers

We deploy consistent underwriting decisions to effectively mitigate credit risk

We have an efficient and scalable, bespoke operating platform

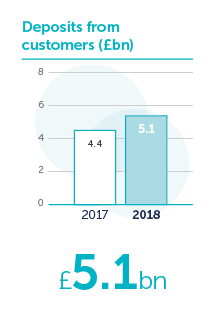

We have a dynamic and sophisticated funding strategy

We aim to deliver strong growth and sustainable returns to our shareholders