Full Year 2016 Results - Another strong year of growth

25 April 2017

Charter Court Financial Services (“Charter Court”), the specialist bank and owner of Precise Mortgages, Charter Savings Bank and Exact Mortgage Experts, today announced its results for the year to 31 December 2016.

Highlights

Ian Lonergan, CEO of Charter Court, said:

“Charter Court’s 2016 results reflect our position as one of the country’s leading specialist mortgage banks by originations. We are tightly focused on our growth markets of specialist buy to let and residential mortgage lending. Since 2008 we have purpose-built a strong distribution, operating and risk management platform from the ground up to address these markets and I am pleased to see that the outcome of that hard work is continuing to be delivered in our financial performance. We remain focused on using our expertise to deliver superior results for our customers and investors.

“Charter Court performed strongly in 2016, capturing strong demand whilst maintaining our strict control of risk. Mortgage originations grew 55% to £2.5 billion, as we maintained our distribution leadership across more than 20,000 intermediaries and affirmed our position as the largest single specialist bank provider through the country’s leading mortgage clubs and networks. Balance sheet growth continued to translate into top line and profit growth and strong organic capital generation in 2016. We are particularly pleased with the performance of our scalable, highly automated, purpose-built operating platform and this allows us to control risk cost effectively. The quality of our mortgage book remains excellent with only 14 out of 23,113 accounts 3 months or greater in arrears, representing 0.06% of our loan book.

“Looking ahead, we see further opportunity as the high street banks continue to struggle with the complexity and sophistication required to serve our specialist mortgage markets. I believe we are well-positioned to meet the challenges and explore the opportunities that the current market environment presents. We expect to continue to leverage our large and growing retail deposit base, alongside access to the Bank of England’s Term Funding Scheme (TFS), and remain strongly capitalised. I am confident that this combination of factors and the strength and momentum in our business will further enhance our ability to deliver on our strategy for sustainable, profitable growth and capital generation whilst optimising our net interest margin and maintaining a very low cost of risk.”

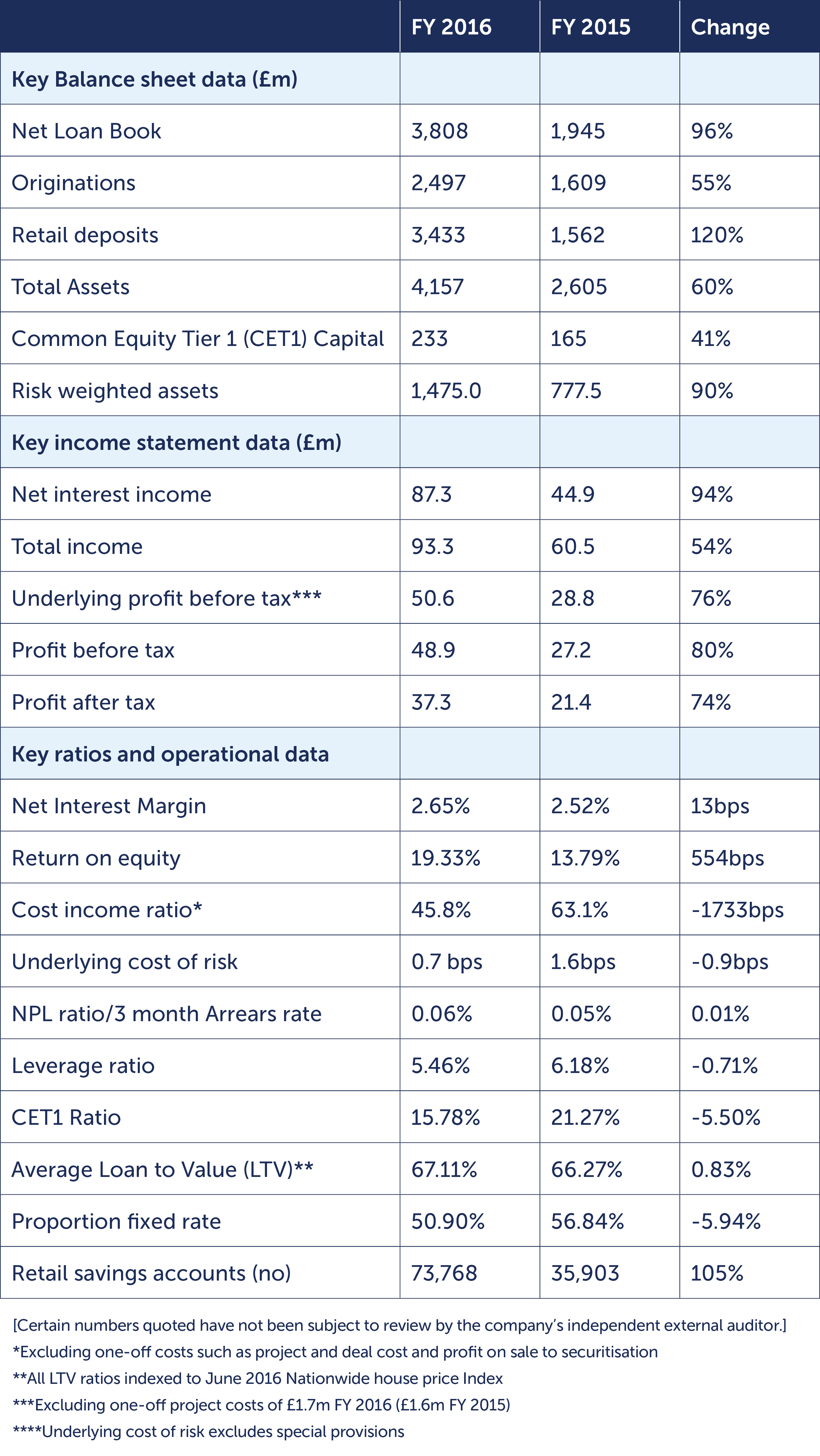

Key Financial results, ratios and metrics

Mortgage Lending

We experienced strong BTL lending growth over the first half as volumes increased significantly ahead of the introduction of higher stamp duty on BTL properties and maintained a year-on-year increase over the second half of 2016 despite the backdrop of macroeconomic and political uncertainty. All new lending was generated organically and strictly in line with our clearly defined risk appetite. This continued to be reflected in our credit performance, recording an underlying cost of risk of just 0.7 bps, down from 1.6bps in 2015. Our net loan book increased by £1.86 billion or 96% to £3.81 billion as at 31 December 2016 (31 December 2015: £1.95 billion). Approximately 58% of our net lending was to the BTL sector with the remainder consisting of specialist residential primary mortgages, second charge mortgages and bridging loans. In line with our strategy, we saw an increase in more complex mortgage lending, for example to SPVs, limited company landlords and for Houses of Multiple Occupancy. As a specialist buy to let and residential lender, all of our lending is secured and we have no direct exposure to the SME or corporate sectors.

Retail savings and funding

We maintain a sophisticated funding platform and view funding as a key component of our business strategy in its own right, not simply a means of supporting asset growth. We continued to pursue our diverse funding strategy over the year, increasing retail deposits by 120% to approximately £3.43 billion at 31 December 2016. This large and growing retail deposit base enhanced our flexibility and together with wholesale funding through securitisation, repo lines, our uncommitted funding facility with a Tier 1 bank and access to the Bank of England’s liquidity facility, has allowed us to raise funds in a cost-efficient manner. This flexible approach to funding allows us to take advantage of market pricing opportunities as they arise and means we are not reliant on pricing or demand in any one market or segment.

Capital position

Our capital and liquidity position provides a solid foundation to help us build and grow and we remain strongly capitalised. As at 31 December 2016, we had a fully loaded CET1 capital ratio of 15.8% (31 December 2015: 21.3%) and a leverage ratio of 5.46% (31 December 2015: 6.18%). We expect to continue to generate capital and adopt a prudent approach to liquidity that provides adequate comfort as the economy steers itself through the prevailing uncertainty.

Business and strategy update

As one of the market leaders in specialist mortgage lending by originations, we have again demonstrated our ability to grow our asset base organically, with a robust performance in 2016 where we completed £2.5 billion (FY 2015: £1.6 billion) in loans to customers. Charter Court’s continued growth is underpinned by the strong relationships we have developed with our partners who deliver our products. We have full coverage of mortgage intermediaries operating throughout the UK who enable us to access customers who are geographically dispersed with wide-ranging needs that are not being met by the high street lenders. Supporting our distribution channels is the automated point of sale digital platform and through its ease of use and speed of service, we are able to deliver a first class service to our partners and end customers. With a deep understanding of the mortgage market and embedded skills and experience, we have gained market share through effective product innovation. Above all, we have done this without compromising on risk management which has allowed us to maintain very low cost of risk whilst delivering increased profitable growth and returns. We remain focused on continuing to develop our products that not only meet customer needs but also deliver sustainable profitable growth.

Outlook

We expect that the economic uncertainty following the referendum on leaving the EU combined with the impact of regulatory change in the BTL mortgage market will lead to a degree of disruption for many of those companies which participate in this sector. However, our BTL applications in 2017 to date remain strong and we are confident that our depth of experience, our strong risk management expertise and the nimbleness of our decision making and operations will continue to position us to react and adapt to change and to explore opportunities that arise as we further pursue our strategy to drive sustainable profitable growth and capital generation.